by Andreas Perez de Fransius, Peace Is Profitable contributor

Many of us have noticed that trust is an important prerequisite for all types of relationships, both sexual and non-sexual ones. However, trust in our fellow human beings not only happens to make life more fun, enriching and exciting but is also a vital ingredient in creating wealth. Whether at the level of countries or individual firms, different amounts of trust can be the difference between indigence and profitability.

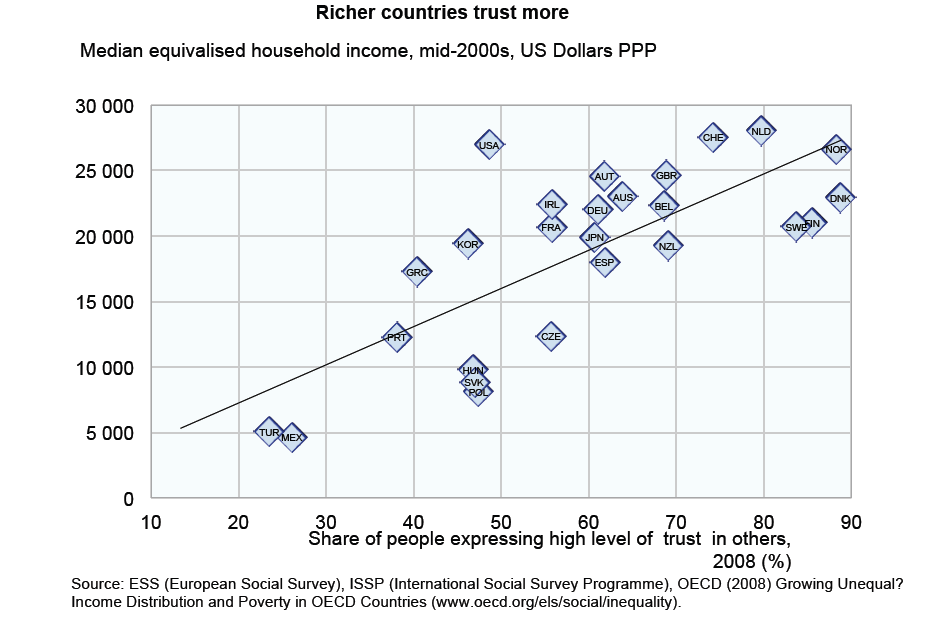

Perhaps unsurprisingly, there are wide gulfs in trusts between people and places. Differences across countries are often particularly glaring, and the wealth of data makes them a practical unit of analysis. Studies by the OECD, a rich-country think-tank, have highlighted how levels of trust in others vary across nations. Interestingly, there is a strong correlation between high indices of trust and income, in this case measured as median household income (on the Y-axis below).

Similar results hold up among other countries, notably in the Latinobarómetro poll of Latin American nations. This is therefore not a phenomenon that is exclusive to developed countries.

This effect is stronger in societies with more even distributions of wealth. Levels of trust are therefore considerably higher in countries where a greater number share in the proceeds, rather than remaining in the hands of a wealthy minority. This suggests that progressive wealth sharing is not only justifiable on grounds of fairness, but also stimulates strong social relationships.

To understand why trust stimulates profitability it is useful to shift our focus onto firms, and how corporate cultures help to shape success. Even in a competitive market economy, corporations need a high degree of co-operativeness in order to thrive. Trust breeds sharing of information and creativity by reducing the personal costs of failure. It also reduces costs, by allowing fewer resources to be devoted to enforcement. When people trust others to uphold agreements, they are less likely to hire expensive lawyers to write-up onerous contracts and to call on law enforcement officials. A recent case of how a lack of trust can act as a dramatic drain on profits can be found in the Financial Times’ account of the broken corporate culture that precipitated the Libor scandal at Barclays’.

Incidentally, trust is also a vital ingredient in peaceful relations, as well as a sexy character trait. As it is also a key source of profitability, trust makes peace both sexy and profitable.